rhode island income tax rate 2020

2020 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Discover Helpful Information and Resources on Taxes From AARP.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

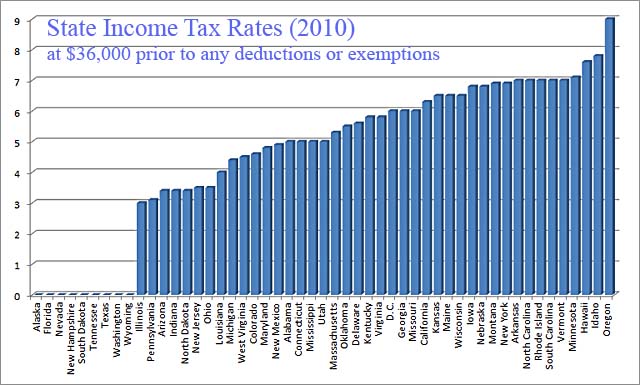

The federal corporate income tax by contrast has a marginal bracketed corporate income taxThere are a total of twenty four states with higher marginal corporate income tax rates then Rhode Island.

. The income tax is progressive tax with rates ranging from 375 up to 599. Some Rhode Island tax-related amounts for 2020 including income tax bracket thresholds and the standard deduction were released Nov. Detailed Rhode Island state income tax.

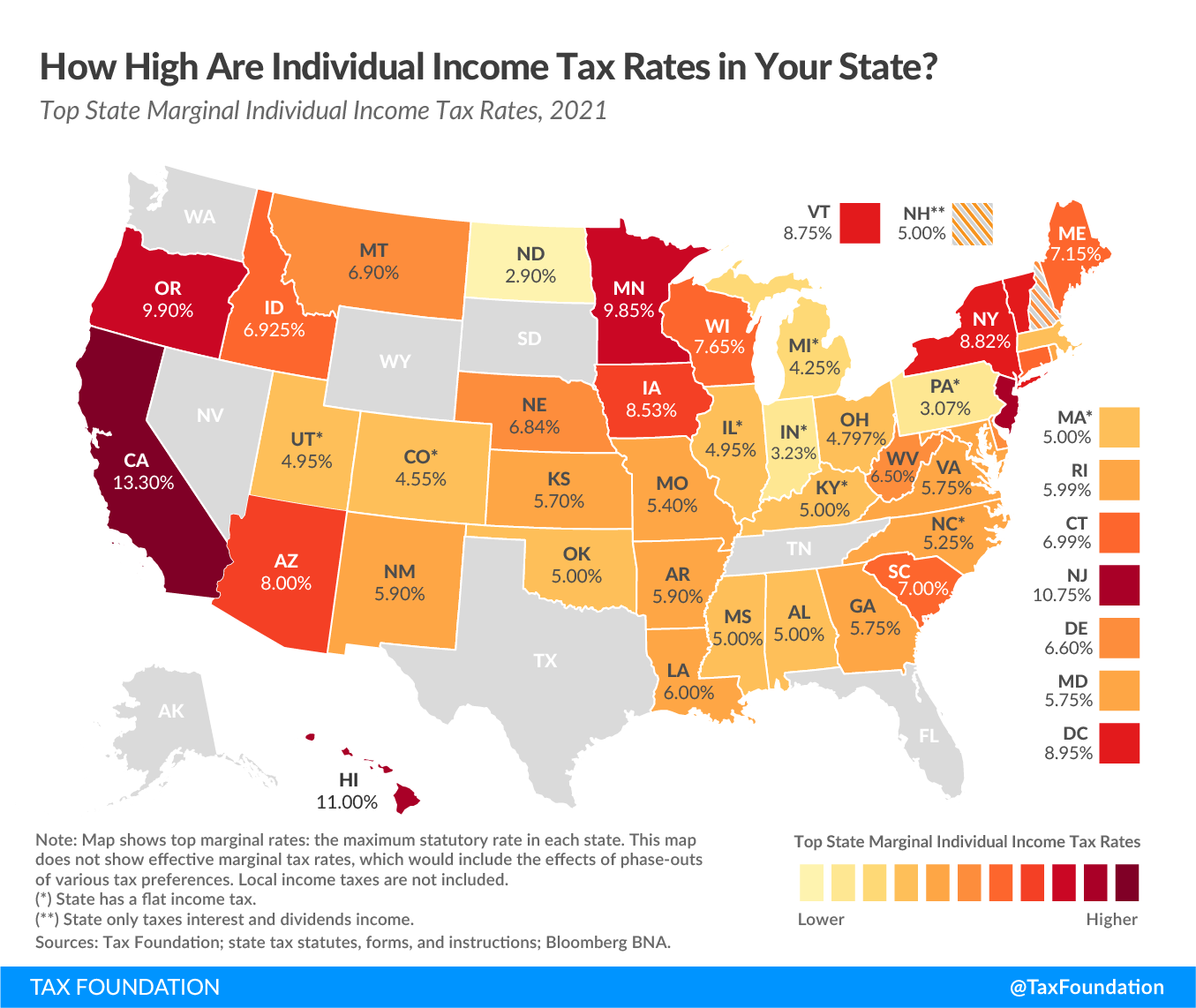

Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

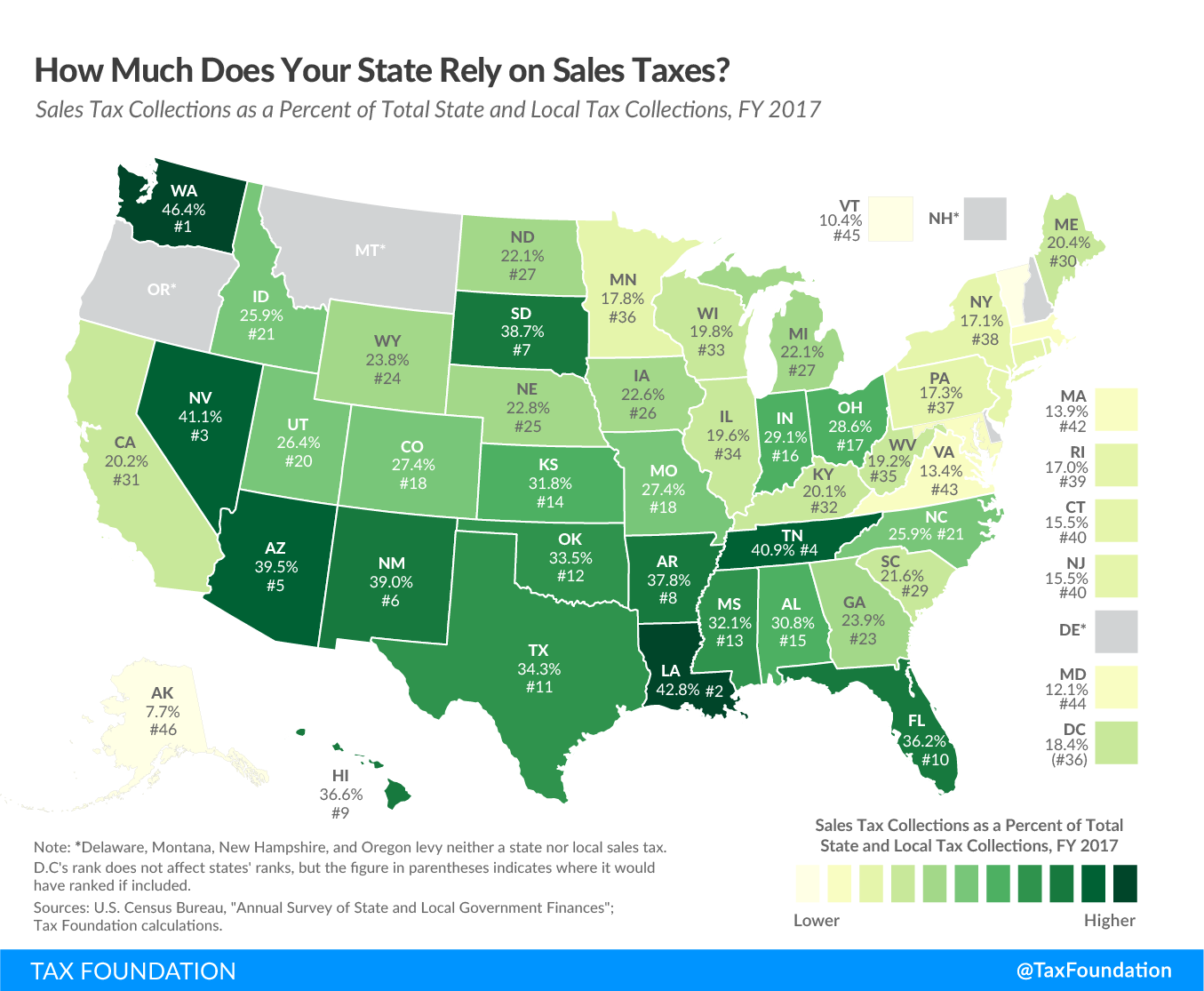

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Calculate your state income tax step by step. Those rates are near the national average for state income taxes and the same is true of the states sales tax which is 7.

Find your gross income. Rhode Island Standard Deduction Single 9050 Married filing jointly or Qualifying widower 18100 Married filing separately 9050 RI income tax from Rhode Island Tax Table or Tax Computation Worksheet. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

207700 to 231500 210750 to 234750. Guide to tax break on pension401kannuity income. Rhode Island Division of Taxation - Page 3 of 5.

The amount of your expected refund rounded to the nearest dollar. The Rhode Island state tax tables listed below contain relevent tax rates and thresholds that apply to Rhode Island. Only the following credits are allowed against Rhode Island personal income tax.

Reminder about taxes on unemployment benefits. How to contact us make payments or use our drop box. Deadline extended for certain exemption certificates.

Your 2021 Tax Bracket to See Whats Been Adjusted. Read our latest newsletter. Personal Income Tax Forms.

Rhode Island has a flat corporate income tax rate of 7000 of gross income. The thresholds separating Rhode Islands three income tax brackets are to increase to 65250 and 148350 up from 64050 and 145600 the division said in a notice. Forms are available in two ways.

Qualifying widow er RI 1040 H Only. 2a 100 allocation to Rhode Island of the gross receipts from sales of tangible personal property sold in the regular course of business where Rhode 2020 RI-1065 - Rhode Island Partnership Income Tax Return SPECIFIC INSTRUCTIONS - page 2. RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 244688 639413 375 475 599 on excess 0 65250 148350.

65250 148350 CAUTION. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that. Read the summary of the latest tax changes.

Which was 5950 for 2020 will be 6000 21. Personal income tax forms contain a 1D barcode. The Rhode Island tax rate is unchanged from last year however the income tax brackets increased due to the annual.

Check the 2020 Rhode Island state tax rate and the rules to calculate state income tax. Please use Microsoft Edge to get the best results when downloading a form. Find your pretax deductions including 401K flexible account contributions.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Get Your Max Refund Today. Tax Bracket gross taxable income Tax Rate 0.

The changes to the Rhode Island tax tables can be long and often contain information that whilst important for the correct calculation of tax in Rhode Island is not relevent to the majority of Rhode Island taxpayers who pay most of their direct tax via their salary income. 1 RI Earned Income Credit - RIGL 44-30-26c2N 2 Property Tax Relief Credit - RIGL 44-33 3 RI Residential Lead Abatement Credit - RIGL 44-303 4 Credit for Taxes Paid to Other States - RIGL 44-30-18 5 Historic Structures Tax Credit - RIGL 44-332. Income tax rate schedule.

Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Rhode Island for single filers and couples filing jointly. 13 by the state taxation division. INCOME TAX AND CREDITS Using a paper clip please attach Forms W-2 and 1099 here.

Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket. For example if your expected refund is between 15150 and 15199 enter 152. Subscribe for tax news.

To have forms mailed to you please call 4015748970. The Rhode Island State Tax Tables below are a snapshot of the tax rates and thresholds in Rhode Island they are not an exhaustive list of all tax laws rates and legislation for the full list of tax rates laws and allowances please see the Rhode Island Department of Revenue website. Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 15 2021.

Read the Rhode Island income tax tables for Married Filing Jointly filers published inside the Form 1040 Instructions booklet for more information. Head of household 13550. Phase-out range for standard deduction exemption amounts by tax year 2020 2021.

Ad Compare Your 2022 Tax Bracket vs. All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format. Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009.

State Corporate Income Tax Rates And Brackets Tax Foundation

The Case For A Tax Swap By Milan Singh Slow Boring

The Case For A Tax Swap By Milan Singh Slow Boring

Do I Have To File State Taxes H R Block

Individual Income Tax Structures In Selected States The Civic Federation

How High Are Capital Gains Taxes In Your State Tax Foundation

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Monday Map Top State Income Tax Rates Tax Foundation

Colorado Income Tax Rate And Brackets 2019

State Income Tax Rates Highest Lowest 2021 Changes

Low Tax States Are Often High Tax For The Poor Itep

States With Highest And Lowest Sales Tax Rates

Individual Income Tax Structures In Selected States The Civic Federation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)