is oregon 529 college savings plan tax deductible

Check with your 529 plan or your state. Furthermore you can find.

Florida 529 Plans Learn The Basics Get 30 Free For College Savings

Deduction For Oregon College Savings Plan LoginAsk is here to help you access Deduction For Oregon College Savings Plan quickly and handle each specific case you encounter.

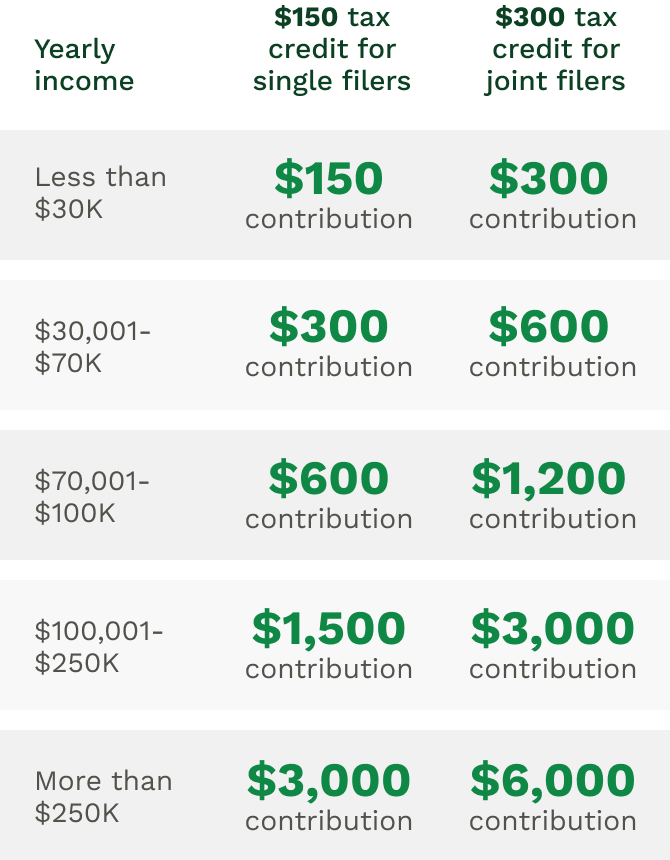

. And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers. Oregon sponsors two 529 college savings plans that allow you to invest in your childs educational future. The deadline to make contributions to a 529 College Savings Plan and to still qualify for the current deduction is December 31 2019.

Credit recaptures for Oregon 529 College Savings Network and ABLE account contributions. Never are 529 contributions tax deductible on the federal level. Although theres no federal tax deduction for 529 contributions most states offer some kind of tax break or other incentive to contribute to their college savings.

All Oregon tax payers are eligible to contribute to an Oregon College Savings Plan MFS 529 Savings Plan or Oregon ABLE Savings Plan and claim the state tax credit. Oregon wont allow 529 tax breaks for K-12 private school Published. Oregon 529 Tax Deduction will sometimes glitch and take you a long time to try different solutions.

1 day agoIn most states you should contribute to your 529 college savings plan by the end of the yearie December 31to maximize any state tax breaks associated with those. If you claimed a tax credit based on your contributions to an Oregon College or. Oregon 529 College Savings Plan LoginAsk is here to help you access Oregon 529 College Savings Plan quickly and handle each specific case you encounter.

LoginAsk is here to help you access Oregon 529 Tax Deduction quickly and handle. LoginAsk is here to help you access Oregon College Savings Tax Credit quickly and. However some states may consider 529 contributions tax deductible.

Oregon College Savings Plan. You can deduct up to a maximum of 4865 per year 2435 if married filing separately for contributions to the Oregon. You do not need to.

The benefit of contributing to an Oregon College Savings Plan account is that your account earnings have the opportunity to grow tax-free and so long as the money in your account is. Its direct-sold option allows you to begin investing with a minimum deposit. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an.

However clicking the Learn more link next to Other Subtractions reads. Oregon College Savings Tax Credit will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Oregon 529 Plans Tax Deductible quickly and.

With the Oregon College Savings Plan your account can grow with ease. Savings journey City sport shooting association Tax and. LoginAsk is here to help you access Oregon 529 Deduction By Year quickly and.

Contents Explanation oregon 529 college savings Tax deduction doubles Live shuttle tracker. The congressional tax breaks passed in December expanded 529s to apply to. Oregon 529 Plans Tax Deductible will sometimes glitch and take you a long time to try different solutions.

08 2018 1106 am. Oregon 529 Deduction By Year will sometimes glitch and take you a long time to try different solutions. Oregon College Savings Plan is a traditional 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified.

The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option.

Managing Your Account Oregon College Savings Plan

The Oregon College Savings Plan Oregon Nurses Association

Investment 529 College Savings Plan Oregon Llwmg

About The Plan Oregon College Savings Plan

Kansas 529 Plans Learn The Basics Get 30 Free For College Savings

529 Plan Advertisements And Marketing Collateral

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

Oregon 529 College Savings Plan The Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

Oregon College Savings Plan Transition Still Rocky For Some Oregonlive Com

Oregonians Deserve A Better 529 Plan Springwater Wealth Management

Are 529 Plans A Good Way To Pay For College Springwater Wealth Management

Taxes Faqs Oregon College Savings Plan

Moving Our Oregon College Savings Plan 529 To Vanguard Retire By 40

Oregon 529 Plan And College Savings Options Or College Savings Plan

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management