espp tax calculator ireland

Employee Stock Purchase Plan ESPP Calculator. Just type in your gross salary select how frequently youre paid.

In summary the taxable value from 1 January 2023 onwards is now calculated based on a combination of the emission levels of the car and the total business mileage carried out.

. The look back price will only take into account the price at. This places Ireland on the 8th place in the International. The actual price you pay for the stock usually including a discount price from your employer The market price of the stock on that day.

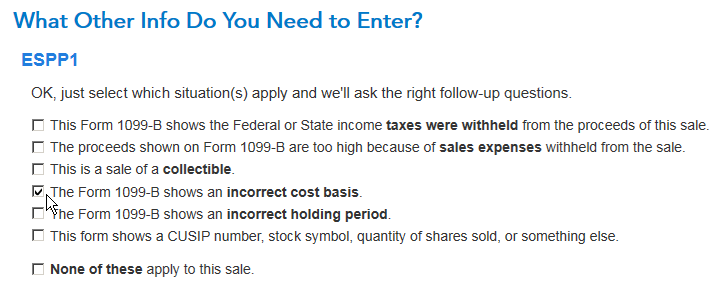

For the ESPP those dates wont matter. This ESPP Gain and Tax calculator will help you 1 estimate your gains from. ESPP schemes are normally treated as share awards and taxed through the Pay as You Earn PAYE system.

Related

- sparkletts water delivery san diego

- dialysis technician jobs in uk

- pruning palm trees florida

- 1956 chevy truck for sale canada

- raspberry puree recipe for mimosas

- dog friendly hotels in evergreen co

- prn rn clinic jobs near me

- is oregon 529 college savings plan tax deductible

- lopez tax service davis rd

- capital gains tax news in india

The personal income tax system in Ireland is a progressive tax system. 2022 2021 Income Tax Calculator TaxCalc allows you to estimate your take home pay based on your total pay pension contribution and personal circumstances. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher.

Price shares are finally sold. Emily made an Exercised Share Profit of 20000. Cost of Shares10000 shares 1 10000.

In most cases the discount you received will be reported as ordinary income in Box 1 of. How to Use the Tax Calculator for Ireland. This is calculated as follows.

1700 2000 300 Number of shares. Annual reporting of grant and purchase required for ESPP if ESPP is treated as an option for purposes of Irish tax law which is generally the case. Value of Shares10000 shares 3 30000.

The majority of publicly. An employee stock purchase plan ESPP is a company-run program in which participating employees can purchase company stock at a discounted price. Again you are in the 24 tax bracket and 15.

You can use our Irish tax calculator to estimate your take-home salary after taxes. Reporting must be completed. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 177450 EUR per month.

ESPP Discount of 15. If the ESPP provides the employee with an option to acquire the. Its important that you understand both in.

To help you with these calculations weve built the following ESPP Gain and Tax calculator. The price could have risen to 200 or dropped to 100 it wont matter. ESPP Basis current About.

This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming.

The Ins And Outs Of Espp S Part 2 Fun With Taxes Financial Geekery

Sold My Espp Shares Nice Profit More Tax Owed

How To Calculate Capital Gains Tax H R Block

Your Employee Stock Purchase Plan Espp Is Worth A Lot More Than 15 Psychohistory

Taxcalc Ie An Irish Income Tax Calculator

Espps 101 Taxation Made Simple Part 1 Mystockoptions Com

The Employee Stock Purchase Plan Is Part Of Your Compensation Brewing Fire

An Employees Guide To Irish Taxes On Rsu S Espp S Eolas Money

Always Participate In The Employee Share Purchase Plan Espp By Charlie Evans Medium

The Minimal Investor Espp Guide And Calculator Minafi

Employee Stock Purchase Plan Espp What Is It Wealthfront

Paylesstax Share Options Rtso1 Tax Calculator Paylesstax

Determining The Fair Value Of Your Espp Human Capital Solutions Insights

Employee Stock Purchase Plan Espp Calculator Dqydj

Espp Gain And Tax Calculator Equity Ftw

Are Espp Esop In Mnc Foreign Assets Or Not

Free Internal Rate Of Return Irr Calculator Carta